Here’s the outcome of the fifth Cashflow game I played. I am pleased to say that I won the game by accumulating $50,000 in monthly cash flow from purchasing businesses on the fast track. The entire game was completed in about 45 minutes, the same amount of time used to complete Game 4. However, I was not the first one to get out of the rat race; I was second. As I was playing this game, I made some interesting observations:

[easyazon_image align=”none” height=”110″ identifier=”B002LG7GN0″ locale=”US” src=”https://ecx.images-amazon.com/images/I/51FL0aMBMoL._SL110_.jpg” tag=”earweaforyouf-20″ width=”76″]

Game five (Using the electronic version with 2 computer opponents)

My Occupation: Doctor

Opponents’ Professions: Army soldier and Policeman

Winner: 1st place: Doctor (me)

2nd place: Army Soldier

3rd place: Policeman

My Observations

- I noticed that as a physician, I had more cash available than my 2 opponents. This allowed me to purchase several 3Br/2Ba houses and duplexes which were giving me positive cash flow.

- I was able to pay down my bad debts with the extra cash–I paid off my credit card debt and car note debt, thereby reducing my expenses.

- The roll of the dice was basically kind to me–I landed on “Baby” once; I was “Downsized” once; and very few “Doodads” were purchased.

- My 2 opponents seemed to not want to buy any stocks or houses–they kept saying things like “not a good ROI” or “Stocks are too volatile for me”.

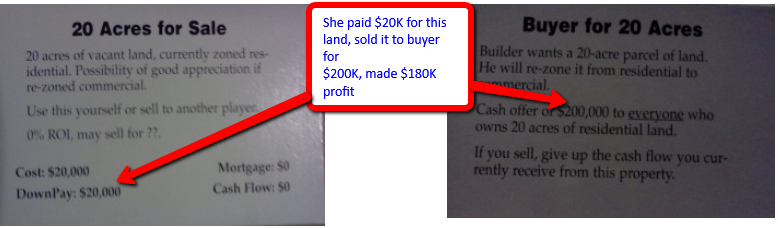

- The army soldier was first to get out of the rat race because she purchased the following and held onto it until she was able to sell it for $200,000 cash with a corresponding Market card:

If you do the math, you will see that she made a profit of $180,000, more than enough passive income to meet her monthly expenses and therefore get her out of the rat race.

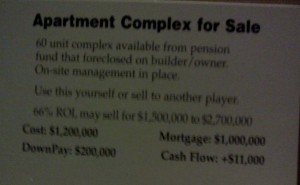

I would have gotten out of the rat race before the army soldier if I had purchased the following:

I decided to pass up this opportunity because I did not have enough cash to make the down payment of $200,000 (I had about $136,000) and I did not want to take out a loan. Taking out a loan would have increased my expenses and I was afraid of taking the risk. If I were presented this opportunity in real life, I admit I would not buy this apartment complex due to fear of being outside of my comfort zone.

Observations made while on the Fast Track

- The army soldier seemed happier making more dream purchases than purchasing businesses to get cash flow. She kept stating that “I’m so rich I can do whatever I want”.

- I was more focused on buying businesses for cash flow, gaining enough income to either buy my dream or earn enough passive income to win the game.

If you want to know more about the Cashflow game (why Mr. Kiyosaki designed it), I highly suggest you read his New York Times best-selling book [easyazon_link identifier=”0446677450″ locale=”US” tag=”healthytobewealthy-20″]Rich Dad, Poor Dad[/easyazon_link]. This book discusses the fundamental differences between his real father (poor dad) and his best friend’s father (rich dad) regarding money and finance and how those differences shaped him into the person he is today.

For more information about the Cashflow game, please read my review by clicking here.

As always, I welcome your comments or thoughts about playing this game. If you are interested in learning how to be successful in either making money online and/or owning a business, then you must increase your financial IQ and also learn the basics of running a business the right way. Click here to find out how you can learn the basics for free.